Summary: Fund managers came into 2018 very bullish equities, with cash levels at 4-year lows and allocations to global equities at 3-year highs. Our view at the time was that "this is a headwind to further gains" in equities. That post is

here.

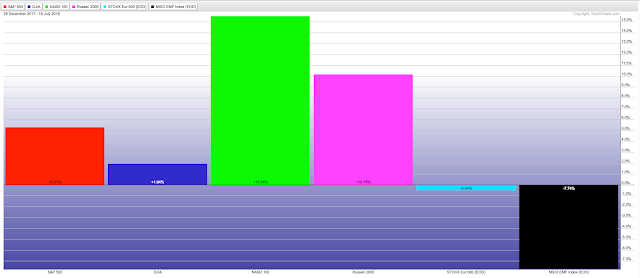

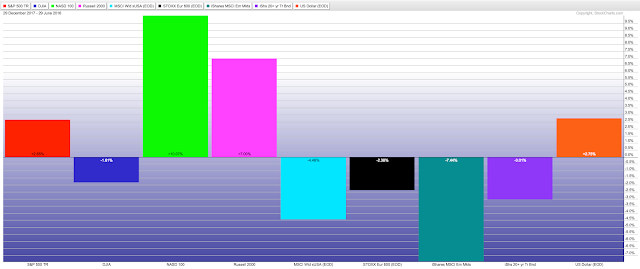

7 months later, global equity allocations have fallen to the lowest level since the November 2016 election, and cash balances are relatively high. Investors are no longer bullish, although the global equity correction has not made them outright bearish by most measures.

The US has been the best performing region of the world in the past year, yet fund managers have been consistently underweight. That has now changed; in July, US allocations rose to a 17-month high. It's not yet extreme, but a big tailwind behind US outperformance is now gone.

Emerging markets have massively underperformed since April when allocations to the region rose to a 7-year high. In July, allocations fell to the lowest since January 2017. This region is now a modest contrarian long again.

Fund managers' are close to neutral on bonds, but their inflation expectations remain near a 14-year high and their commodity allocations are near an 8-year high. This has previously led US 10-year yields to stagnate or fall.

* * *

Among the various ways of measuring investor sentiment, the Bank of America Merrill Lynch (BAML) survey of global fund managers is one of the best as the results reflect how managers are allocated in various asset classes. These managers oversee a combined $600b in assets.

Our sincere gratitude to BAML for the use of this data.

The data should be viewed mostly from a contrarian perspective; that is, when equities fall in price, allocations to cash go higher and allocations to equities go lower as investors become bearish, setting up a buy signal. When prices rise, the opposite occurs, setting up a sell signal. We did a recap of this pattern in December 2014 (

post).

Let's review the highlights from the past month.

Overall: Relative to history, fund managers are

overweight cash and commodities, underweight equities. Enlarge any image by clicking on it.

Within equities, the US is now overweight while emerging markets in particular are now underweight. This is a significant change from the past year.

A pure contrarian would overweight emerging markets equities relative to the US and underweight cash.