The short story is this: 3 of the 4 US indices, plus Europe and EEM all closed more or less where they ended last week. The main exception was RUT.

For SPY, the line in the sand is still the 50-dma near 181. Unless that is breached, Scenario 2 is in play. For more details on what that means, please read The Two Scenarios Post and The Follow Up to the Two Scenarios Post.

Below 181 puts SPY back in the prior consolidation area (yellow) and the two attempts to break higher look to have failed. If 182 holds on a pull-back, you have the potential for a large inverted Head and Shoulders pattern to take the index higher.

Two positives: first, NDX made a new high early this week before closing flat. Second, RUT was the only US index to make a discernable move; on Friday, it had its highest close since January 23rd (its high was January 22nd). Like SPY, below 1145 will make the break higher in RUT look like a failure.

A smart comment from @trade_well this week puts the current set up in context: "markets chop sideways when the short term trend (20-dma) is below the long term trend (50-dma)." That is the situation with most of the indices and sectors at the moment. The exceptions are the leaders: technology, utilities and healthcare in the US, and the Euro 350 abroad.

Among sectors, it is encouraging to see semiconductors making new highs. This is a growth leader.

What is not encouraging is this: At the mid-Janurary high, financials, industrials, discretionary and other cyclicals were at a peak. In the chart below, note that they are now mostly 2% or so off their peak, with SPX essentially back at its highs. Utilities and healthcare are the prime reason the index has performed as well as it has since then. Strip out those sectors and SPY would be trading close to its 50-dma at 181. More on that later.

The rise in commodities is also not encouraging. We have been pro-commodities over the past several months (starting here). Our thesis has been:

- If there is an acceleration in fundamental growth (as the pundits believe), then it should flow into commodity prices.

- Investors are massively underweight commodities.

But the thesis, so far, has been only half right. What is driving the CRB higher is not industrial metals and energy, but instead precious metals and agriculture. PMs are rallying based on lower real interest rates and Ags are rallying based on bad weather. Nothing here is signaling stronger growth.

Seasonality was accurate in expecting this past week to be flat. The coming week is more typically weak. March brings seasonal strength; on any downside, holding the respective 50-dma is the essential task for the week ahead (chart from Stock Traders Almanac).

The Longer Story

There's a fundamental story playing out in parallel to the technical story that is perhaps insightful for the months ahead.

Macro data has been much weaker than expected. Some attribution to 'weather' is certainly warranted but the bigger picture has been unfolding for more than a year, and is unchanged: demand growth is stuck at 2-3%.

It is a very consistent picture. Start with real retail sales. Even before the latest print, the trend had been flat since 2011.

The same is true with industrial production, GDP, PCE, rail volume growth and any number of other macro data points.

This really should not be much of a surprise. The bond market and equity market have been signaling weaker growth for two months: yield paying utilities and REITs (and treasuries) are leading the market while growth sectors are lagging. This is as true from the January high as it is from the February low.

Expectations had been for higher growth. FY14 expected EPS started the year at 10% growth. To put that in context, guidance for 1Q14 is now for 0.9% EPS growth on sales of 2.5%. For FY13, sales growth was just 1.8%, in line with the macro growth figures above. It's a consistent picture of positive but slow growth.

The bridge between sales growth (2-3%) and higher EPS growth is margin expansion. Arguably, expectations are too high for 2014 (chart from Morgan).

Add to this story the following: fund managers have positioned themselves for growth. According to BAML, funds have a record overweight in financials and their largest position is in technology; at the same time, they have a record underweight in defensive sectors, like staples. A full post on this is here.

Low growth does not imply a precipitous fall in equity prices, per se. It is instead further fundamental support to go along with the technical rational of our Scenario 2. The two stories are consistent.

The string of weak macro data pushed the Citi Economic Surprise Index below zero for both the US and G10 this week. You can see there is a discernable seasonal pattern to weak CESI that has corresponded with the lows in equities mid-year every year since 2010.

Prior to 2013, when CESI went below zero, SPX had a strong tendency to revert to its 200-dma (red line; chart from Ed Yardeni).

The current streak of the SPX over the 200-dma is already the 4th longest of the past 30 years. In the next month, it will overtake the one ending 1994. The trend has ended each time with either a pretty solid drawdown or a long sideways consolidation that has set up the next leg higher in the market (chart from Price Action Lab).

* * *

In summary: the move higher in the indices and sectors is a clear positive and consolidating at current levels is likely to resolve with at least marginal new highs in SPX. Sector leadership, the CRB, macro data and corporate results, however, are consistent with only modest growth. Therefore, our expectation remains that 2014 will come to resemble the consolidating sideways pattern of 2005 and 2011 as opposed to the consensus view of >10% appreciation.

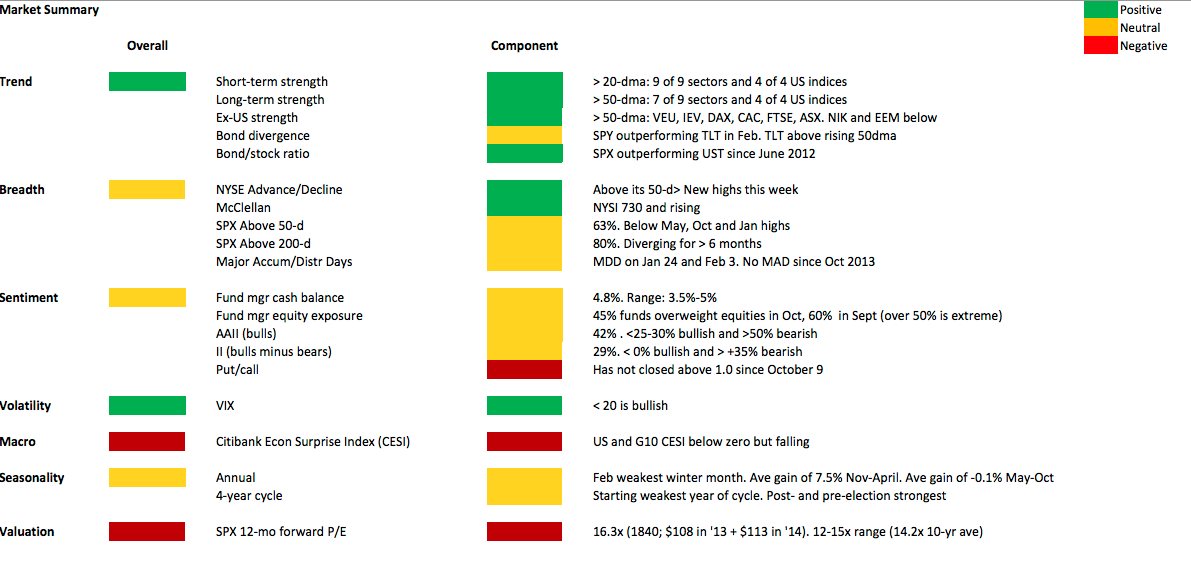

Our summary table follows below.