- Employment growth is close to the best since the 1990s, with an average monthly gain of 220,000 during the past year.

- Compensation growth is the highest in more than 6 years: 2.5% yoy in December.

- Most measures of demand show 3-4% nominal growth. Personal consumption growth the last fours quarters has been the highest in 8 years.

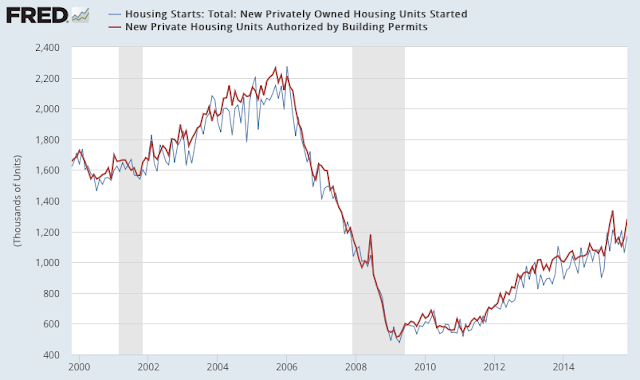

- New housing sales, starts and permits remain near an 8 year high.

The main negatives are concentrated in the manufacturing sector:

- Core durable goods growth fell 5% yoy in November. It was weak during the winter and there has been little rebound since. Industrial production has also been weak, falling -1.2% yoy.

- The core inflation rate remains under 2%, but note that CPI is beginning to tick higher.

Prior macro posts from the past year are here.

* * *

Our key message over the past 2 years has been that (a) growth is positive but modest, in the range of ~3-4% (nominal), and; (b) current growth is lower than in prior periods of economic expansion and a return to 1980s or 1990s style growth does not appear likely.

Modest growth should not be a surprise. This is the typical pattern in the years following a financial crisis like the one experienced in 2008-09.

This is germane to equity markets in that macro growth drives corporate revenue, profit expansion and valuation levels. The saying that "the stock market is not the economy" is true on a day to day or even month to month basis, but over time these two move together. When they diverge, it is normally a function of emotion, whether measured in valuation premiums/discounts or sentiment extremes.

Let's review each of these points in turn. We'll focus on four macro categories: labor market, inflation, end-demand and housing.

Employment and Wages

The December non-farm payroll was 292,000 new employees plus 50,000 in revisions. In the past 12 months, the average gain in employment was 220,000. Gains in 2014 and 2015 are the highest since the 1990s.

Monthly NFP prints are normally volatile. Since 2004, NFP prints near 300,000 have been followed by ones near or under 100,000. That has been a pattern during every bull market; NFP was negative in 1993, 1995, 1996 and 1997. The low print of 119,000 in March, as well as the 'disappointingly weak' print in September, fit the historical pattern. This is normal, not unusual or unexpected.

Why is there so much volatility? Leave aside the data collection, seasonal adjustment and weather issues, appreciate that a "beat" or a "miss" of 80,000 workers in a monthly NFP report is equal to just 0.05% of the US workforce.

For this reason, it's better to look at the trend; in December, trend growth was 1.9% yoy. Annual growth continues to be close to the highest since the 1990s. Employment growth in 2014-2015 has been better than at any time during the 2003-07 bull market.

The labor force participation rate (the percentage of the population over 16 that is either working or looking for work) continues to fall. This has little to do with the current recovery; the participation rate has been falling for 15 years. Participation is falling as baby boomers retire, exactly as participation started to rise in the mid-1960s as this group entered the workforce. Another driver is women, whose participation rate increased from about 30% in the 1950s to a peak of 60% in 1999.

Average hourly earnings growth in December was 2.5% yoy, the highest in more than 6 years. Sustained acceleration in wages would be a big positive for consumption.

3Q15 employment cost index shows compensation growth was 2.1% yoy. This is down from 2.7% in 1Q15, which was the highest growth since the recession.

For those who doubt the accuracy of the BLS employment data, federal tax receipts are also accelerating (red line), a sign of better employment and wages (data from Yardeni).

Inflation

Despite steady employment growth, inflation remains below the Fed's target of 2%. But note: CPI is beginning to tick higher.

CPI (blue line) was 0.4% last month. The more important core CPI (excluding more volatile food and energy; red line) grew 2.0%, the highest level since October 2012.

The Fed prefers to use personal consumption expenditures (PCE) to measure inflation; total and core PCE were 0.4% and 1.3% yoy, respectively, in November. Neither has been above 2% since 2Q 2012.

For some reason, many mistrust CPI and PCE. MIT publishes an independent price index (called the billion prices index). It tracks both CPI and PCE closely.

Demand

Regardless of which data is used, real demand has been growing at about 2-3%, equal to about ~3-4% nominal.

Real (inflation adjusted) GDP growth through 3Q15 was 2.1% yoy (it was 2.9% in 3Q14, so the yoy comparable is unfavorable). 3Q growth was near the middle of the post-recession range (1.5-3.0%) but lower than the 2.5-5% common during prior expansionary periods since 1980.

Stripping out the changes in GDP due to inventory produces "real final sales". This is a better measure of consumption growth than total GDP. In 3Q15, this grew 2.1% yoy (it was 3.0% in 3Q14, so here too the yoy comparable is unfavorable). A sustained break above 2.5% would be noteworthy.

Similarly, the "real personal consumption expenditures" component of GDP (defined), the component which accounts for about 70% of GDP, grew at 3.1% yoy in 3Q15. The last four quarters have seen the highest growth rate in 8 years. This is approaching the 3-5% that was common in prior expansionary periods after 1980.

On a monthly basis, the growth in real personal consumption expenditures was 2.5% yoy in November (it was 3.2% a year ago, making the yoy comparable unfavorable).

GDP measures the total expenditures in the economy. An alternative measure is GDI (gross domestic income), which measures the total income in the economy. Since every expenditure produces income, these are equivalent measurements of the economy. A growing body of research suggests that GDI might be more accurate than GDP (here).

Real GDI growth through 3Q15 was 2.1% yoy. This is near the low end of the range of prior expansionary periods since 1980 (2.5-5% yoy).

Real retail sales grew 0.9% yoy in the past month (it was 3.6% a year ago, making the yoy comparable unfavorable). The range has generally been centered around 2.5% yoy for most of the past 20 years. The latest month is below the low end of the range. Excluding gas station sales, real retail growth would be about 3% yoy.

Retail sales this year have been strongly affected by the large fall in the price of gasoline. Retail sales at gasoline stations fell by 20% yoy. Retail sales excluding gas stations grew 3.6% (nominal) in November.

The main negatives in the macro data are concentrated in the manufacturing sector, as the next several slides show. It's important to note that manufacturing accounts for less than 10% of US employment, so these measures are of lesser importance.

Core durable goods orders (excluding military, so that it measures consumption, and transportation, which is highly volatile) fell 5% yoy (nominal) in November. It grew 4% a year ago, so the yoy comparable is unfavorable. During the heart of the prior bull market, growth was typically 7-13%. Weak growth in winter has been a pattern the past three years (arrows), but it has not bounced back this year.

This is a nominal measure and thus negatively impacted by the fall in the inflation rate. On a real basis, growth continues to trend higher (blue line is real; gray line is nominal; chart from Doug Short).

Industrial production growth was -1.2% in November. The more important manufacturing component (excluding mining and oil/gas extraction; red line) grew 1.0%. It's a volatile series: manufacturing growth was lower at points in both 2013 and 2014 before rebounding strongly.

Housing

Housing starts in November were near a new 8 year high. New home sales grew 9% yoy. Overall levels of construction and sales are small relative to prior bull markets but the trend is clearly higher.

First, new houses sold was 490,000 in November; yoy growth was 9%.

Second, overall starts in November were near a new 8 year high. The annual growth rate was 16% yoy.

Single family housing starts (blue line) were the highest since the recession. Multi-unit housing starts (red line) is flat over the past year.

Summary

In summary, the major macro data so far suggest positive, but modest, growth. This is consistent with corporate sales growth. SPX sales growth the past year has been positive but only about 2% (nominal) excluding energy.

With valuations above average, the current pace of sales growth is likely to be the limiting factor for equity appreciation. This is important, as the consensus expects earnings to grow 8% in 2016.

Modest growth should not be a surprise. This is the classic pattern in the years following a financial crisis like the one experienced in 2008-09.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.