* * *

For the week, SPY lost 0.8% while NDX and RUT lost 0.4%.

Even with minor losses, SPY gave up all of its gains from the prior 3 weeks. Recall, the market had gained in each of those 3 weeks, which illustrates just how shallow the advance has been.

Just 18 points separates the past 6 weeks' closes in the S&P (2118, 2108, 2116, 2123, 2126, 2107). 5 of these 6 closes are separated by less than 0.5%.

Financials, which had closed at a 7 year high a week ago, lost 1.2% this week; that's not a lot but it was enough to put the sector back to where it was trading in early December.

In short, upward momentum has been very weak, a situation we think is likely to persist until there is a more complete washout in breadth and a reset of sentiment.

Let's discuss a possible short term set up and then the longer term picture.

The more than 1% fall on Tuesday and then rise on Wednesday created a lower high. The market traded down on both Thursday and Friday. This looks like a corrective A (down), B (up) and C (down) pattern. If so, the target is the 209-210 area. The strong down momentum created on Tuesday appears to still be in the process of dissipating, a typical pattern we discussed this week here.

That pattern is also seen in short term breadth. Since late January, the lows in SPY have formed when only about 5% of the stocks in the index are at a 10 day high (yellow shading). Several of these lows have had double bottoms in breadth (arrows; chart from Index Indicators).

Note that SPY is already down 2 days in a row and it hasn't been down a third day since March. As discussed below, early June seasonality is usually a tailwind for higher prices. All of this suggests a possible bounce higher short term.

Now, on to the longer term picture.

While the trend is weak, it is positive. SPY has been making higher lows since February, during which it hasn't spent more than 2 days in a row below its rising 50-dma (blue line). In fact, that has been a good buy point for the past 3 months. That level, and the rising trend line, are between 209-210 (as is weekly S1), a key area to watch on weakness in the week ahead.

In the top panel, note that momentum, both up and down, has been very weak: RSI has not become overbought or oversold in 3 months. If this pattern holds, weakness early next week will put RSI near 30 where the index has many times turned higher. That would likely correspond with the price level mentioned above.

Likewise, on a weekly timeframe, SPY has held above its rising 20-wma since January (blue line). Remarkably, it has not been overbought or oversold since November (top panel). This is the longest such period of the current bull market. It's either a slow upward grind or a market that is running on fumes.

Breadth suggests the latter is more likely the case. Participation in the rally is trending lower (bottom two panels). It has been 7 1/2 months since the index has been oversold (less than 30% of stocks above their 50-ema). The only longer streak since 2000 was the 8 months ending in February 2007; in the next month, SPY dropped 7%. That's not meant as a scary data point so much as a recognition that uptrends lose stream over time and an occasional washout is needed to reignite upward momentum.

The feeling of distribution can also be seen in cumulative tick (bottom panel). When tick is downtrending, it means that more stocks are trading on offer than on bid. That is normally associated with motivated sellers and a downtrending market. But sometimes these diverge; in the past year, these divergences have preceded falls in equities in August, October and December 2014 (top panel). The current divergence has lasted 6 weeks, the longest in the past year.

Both NDX and RUT are also trending higher. NDX made a 15 year closing high this week. It has held above its trading range from March and April (shading). A rising trend line is about 1.5% lower. Note the loss of momentum at this week's high (top panel). A test of the trend line could be ahead.

The uptrend in RUT is much weaker. RUT made it's most recent high in mid-April, 6 weeks ago, and has meandered ever since. Its 50-dma is dead flat. A strong positive is that it has held above its 2014 trading range for the past 4 months (shading). On weakness, the rising channel bottom is about 1.3% lower.

So price says the trend for all the indices is higher but breadth suggests the uptrend is losing steam and the indices are at risk of falling lower.

Sentiment is, on balance, heady, a topic we wrote about last week (here). Sentiment suggests that the market is not likely to run away higher. To take one example, sentiment for Nasdaq market timers is at a bullish extreme from which the index normally trades lower (from Mark Hulbert).

Moreover, longer term, equity allocations relative to cash have spiked up in the past 2 months. Those spikes tend to be followed by below average performance in the indices (chart from Sentimentrader).

Volatility spiked higher by 16% on Tuesday, then subsided again. There remains a set up for volatility to increase near term, a topic we wrote about this week (here). That is also a risk to equity appreciation in the near term.

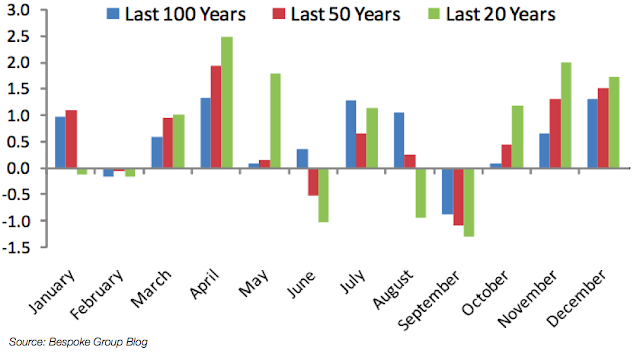

Equities are seasonally weak in June; it's one of two very weak months in the year (chart from Bespoke).

That has especially been the case in the past 10 years; the Dow has been up only twice in June since 2005 (chart from Chad Gassaway).

That said, June tends to start strong. Or, put another way, whatever strength the market has comes at the beginning. This would support the short term set up discussed earlier (chart from Sentimentrader).

The biggest macro market moving event of the month is on Friday when the May non-farm payroll (NFP) report is released. NFP day itself has become a toss up but the week after has a strong tendency to trade lower, which fits the seasonality chart above.

In summary, a ABC corrective pattern to the 209-210 area (trend line, 50-dma and weekly S1) is possibly setting up. Daily RSI is nearing 30, which has marked lows since early March. SPY is already down 2 days in a row and hasn't been down a third day since March. And early June seasonality is usually a tailwind. All of this suggests a possible bounce higher short term.

But beyond that, the upside in US equities seems limited: momentum is very weak and breadth suggests the uptrend is running on fumes. We think the lazy market environment is likely to persist until there is a more complete washout in breadth and reset of sentiment. This is the longer term set up as we enter June, one of the weakest months of the year for equities.

Our summary table follows.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.