Fund managers' cash remains at the highest levels since the panic of 2008-09. This is normally contrarian bullish.

Moreover, allocations to equities dropped over the past two months to the lowest level in 3 years. Equity allocations are now below average and at levels where prior lows in price have formed.

One concern is that fund managers remain very overweight "risk on" sectors: allocations to discretionary, banks and technology are above their means. Allocations to defensive sectors, like staples, are still low. In other words, there's a chance fund managers will make a further run to safety in the coming month(s).

Regionally, allocations to the US and emerging markets are at low levels from which they normally outperform on a relative basis. The dollar is also considered highly overvalued, and BAML fund managers have been prescient in the past in calling turning points in the dollar.

* * *

Among the various ways of measuring investor sentiment, the BAML survey of global fund managers is one of the better as the results reflect how managers are allocated in various asset classes. These managers oversee a combined $600b in assets.

The data should be viewed mostly from a contrarian perspective; that is, when equities fall in price, allocations to cash go higher and allocations to equities go lower as investors become bearish, setting up a buy signal. When prices rise, the opposite occurs, setting up a sell signal.

To this end, fund managers became very bullish in July, September, November and December 2014, and stocks have subsequently sold off each time. Contrariwise, there were some relative bearish extremes reached in August and October 2014 to set up new rallies. We did a recap of this pattern in December (post).

Let's review the highlights from the past month.

Fund managers cash levels remained over 5% for a third month, the first time it's been this high for three months in a row since late-2008 and early-2009. This is an extreme and it's normally very bullish for equities (green shading).

Fund managers are +17% overweight equities, a massive drop from +41% last month and near +60% at the start of 2015. This is the lowest equity allocation since 2012. A washout low, with investors showing fear, takes place with equity allocations under 15-20%. This is therefore bullish.

Equity allocations often continue to fall after the low in equities. In the chart above, note this pattern in 2006, 2010 and 2012.

US exposure increased to -6% underweight in September. Despite low exposure, US equities have outperformed the past 5 months. US equities have been under-owned and should continue to outperform those in Europe and Japan on a relative basis (see below).

Eurozone exposure was +60% overweight in March, the highest in the survey's history. It is still high, at +45% overweight. This is 1.2 standard deviations above the long term mean. Judging from 2006, European equities are at risk of underperforming.

Eurozone exposure was +60% overweight in March, the highest in the survey's history. It is still high, at +45% overweight. This is 1.2 standard deviations above the long term mean. Judging from 2006, European equities are at risk of underperforming.

Allocations to Japan dropped to a 15 month low (+22% overweight). This is still 0.7 standard deviations above the long term mean. Prior to September, allocations the past 10 months were the highest since April 2006. The region has recently started to underperform.

Emerging markets exposure dropped to another all-time low of -34% underweight. Fund managers have been right to underweight this region, but current allocations are an extreme comparable only to early 2014, from which the region began to strongly outperform for the next half a year.

Fund managers have been prescient in judging the dollar to be overvalued. That is their current view (the other times were 10/04, 11/08, 6/10 and 6/12). Each time, emerging markets (solid line) rallied by an average of 8% over the next 3 months.

Those periods where the dollar was considered overvalued are shown below (lines).

Fund managers are -50% underweight bonds (a rise from -60%), about 0.4 standard deviations below the long term mean. Bonds continue to be the most underweighted asset class and this, in large part, explains why cash balances have not been lower that 4.5% in two years. Fund managers have been right to be underweight bonds, but note that bonds have now strongly outperformed in the past 4 months.

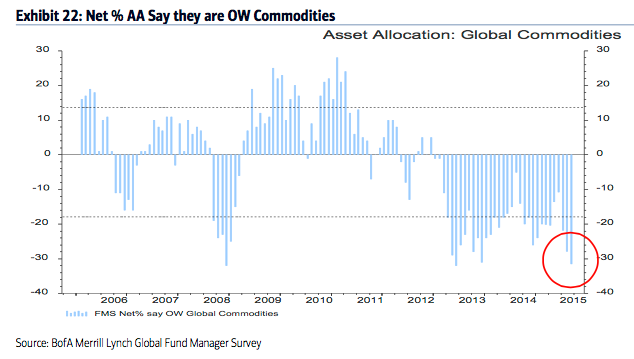

Allocations to commodities fell to -32% underweight from -11% underweight in June. This is 1.9 standard deviations below the long term mean and a 28 month low. The low allocation to commodities goes together with pessimism towards emerging markets and also explains why cash balances are high.

While managers have reduced their equity exposure, they remain overweight the highest beta equities (technology, discretionary, banks). The largest underweights are in commodities (including energy and materials). Fund managers are still -9% underweight defensive staples.

Fund managers allocations to energy dropped to -33% underweight, a new all-time low. This is 2.7 standard deviations below the mean.

In the US, pharma (biotech), discretionary, banks and tech are the most favored sectors. This has been the case for many months. Utilities, staples, telecoms (defensives) remain underweighted, with energy.

In summary: Fund managers are now overweight cash and have reduced their equity allocations to 3-year lows. These two actions are consistent with positive equity performance in following months. That might be especially true for the US and emerging market equities. Continued high allocations to cyclicals (tech, banks, discretionary) are the biggest concern; in other words, there's a chance fund managers will make a further run to safety in the coming month(s).

Survey details are below.

- Cash (5.5%): Cash balances rose to 5.5% (same as July). July and September are the highest cash levels since December 2008. Typical range is 3.5-5%. BAML has a 4.5% contrarian buy level but we consider over 5% to be a better signal. More on this indicator here.

- Equities (+17%): A net +17% are overweight global equities, down from +41% in August. This is 0.5 standard deviations below the mean and thus bullish. Over +50% is bearish. A washout low (bullish) would be under +15-20%. More on this indicator here.

- Regions:

- US (-6%): Exposure to the US increased from -14% to -6% underweight. It was -19% underweight in May, the lowest since January 2008. For comparison, it was +24% overweight in January.

- Europe (+45%): Exposure to Europe dropped slightly to +45% overweight from +47% overweight in August.

- Japan (+22%): Managers are +22% overweight Japan, a big drop from +40% in August. Funds were -20% underweight in December 2012 when the Japanese rally began.

- EEM (-34%): Managers dropped their EEM exposure to -34% underweight. This is the lowest in the survey's history.

- Bonds (-50%): A net -50% are now underweight bonds, a rise from -60% in July and August. For comparison, they were -38% underweight in May 2013 before the large fall in bond prices.

- Commodities (-32%): Managers commodity exposure decreased further to -32% underweight from -11% underweight in June. This is a 28-month low and 1.9 standard deviations below the long term mean. Low commodity exposure goes in hand with low sentiment towards EEM.

- Macro: Less than 20% expect a stronger global economy over the next 12 months, a 3 year low. This compares to a net -20% in mid-2012, at the start of the current rally.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.